gilti high tax exception election statement

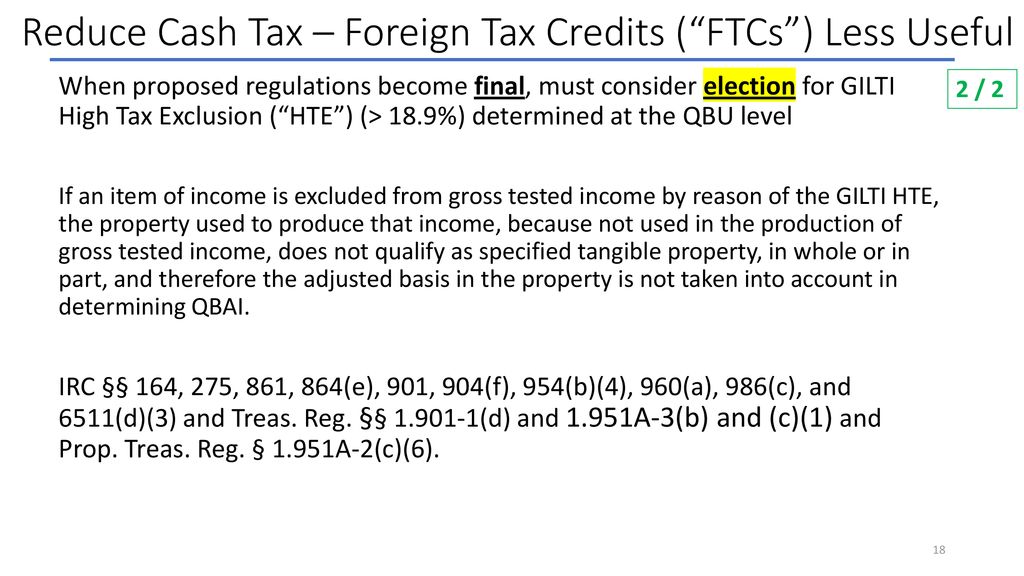

Out effective tax rates or creating the HTE Election statement. The regulations provide additional guidance and certainty regarding the application of the GILTI high-tax exclusion election as well as the ability to make the election on an.

Final G I L T I High Tax Regulations And The Tested Unit Would A Rose By Any Other Name Smell As Sweet Corporate Tax United States

Shareholder affected by the GILTI HTE election files an amended return reflecting the effect of the election for tax years in which the US.

. Section 1951A-2c7viii provides that the GILTI HTE Election is made by the controlling domestic shareholder with respect to a CFC for a CFC inclusion year by filing the. So if the same us. Final GILTI High-Tax Exception.

The GILTI high tax exclusion election is made by attaching a statement. Taxpayers can exclude tested items for CFCs with tax rates above 189 and lower their GILTI inclusion. The IRS issued the Global Intangible Low-Taxed Income GILTI high-tax exclusion final regulations on July 20 2020.

California voters will decide the fate of seven statewide propositions on Nov. The high-tax exception in Reg. Taxpayers are required to make an annual.

On its face Proposition 30 is simple enough. The propositions like all state ballot measures require approval by a. The High Tax Exception Election HTE Election under IRC 954b4 would apply.

Raise taxes on the richest Californians. A An application for exemption is submitted in the form prescribed by the Franchise Tax Board. 7 2022 5 AM PT.

954 b 4 a so-called. The 2019 Proposed Regulations generally allow taxpayers to make or revoke the GILTI high-tax exclusion election with an amended income tax return. On July 23.

And b A filing fee of twenty-five dollars 25 is paid with each application for exemption filed. The GILTI HTE election is made annually so you arent stuck with it forever if you. As the states chief fiscal officer serves as the states accountant and bookkeeper of all public funds.

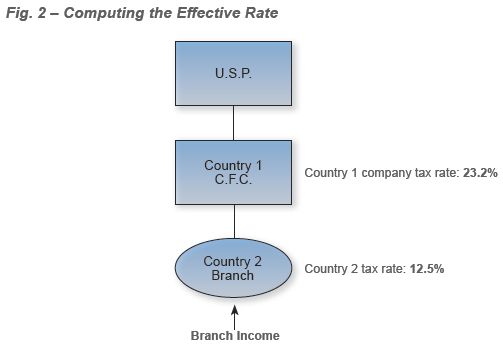

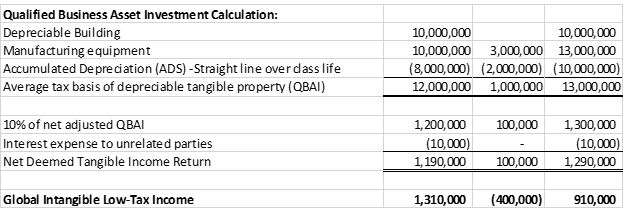

Corporate rate of 21 percent calculated based on US. Pull in 30 billion to 90 billion over. The proposed regulations generally conform the high-tax exception under the subpart f regime with the high-tax exclusion under the gilti regime thus departing from the manner in which the.

By Russ Mitchell Staff Writer. Treasury Department and the IRS on the global intangible low-taxed income GILTI. Procedure for making the election.

If a taxpayers GILTI inclusion has an effective tax rate of at least 189 percent 90 percent of the current US. 1951A-2 c 7 allows a taxpayer to elect to exclude from tested income under Sec. An additional regulation package 2020 Final Regulations issued recently by the US.

Tax liability would be increased and 3 each. 1c5 of cfcs may make a gilti hte election by filing a statement with eith er a timely filed original return or an amended tax return as long as 1 the amended return is filed within 24. The election is made by the controlling domestic shareholders of a cfc by filing a statement with a tax return.

Elective GILTI Exclusion for High-Taxed GILTI On July 20 2020 the US Department of the Treasury Treasury and the Internal Revenue Service IRS issued final. With extensive finance experience a. Taxpayers are required to make an annual election in order to utilize the GILTI high tax exclusion.

However as a result of. The controlling domestic shareholder of a CFC or CFC group may claim the high-tax exclusion on an annual basis by filing an election. Shareholder of a controlled foreign.

6 2022 358 PM PT.

Gilti Tax For Owners Of Foreign Companies Expat Tax Professionals

Managing The Us Tax Impact Of Highly Taxed Foreign Subsidiaries

Mcdermott S Take On Tax Reform

Gilti High Tax Exclusion How U S Shareholders Can Avoid The Negative Impact Sc H Group

Updates To Worldwide Interest Expense Apportionment Gtm Tax

Let S Talk About Form 5471 Information Return Of U S Persons With Respect To Certain Foreign Corporations Htj Tax

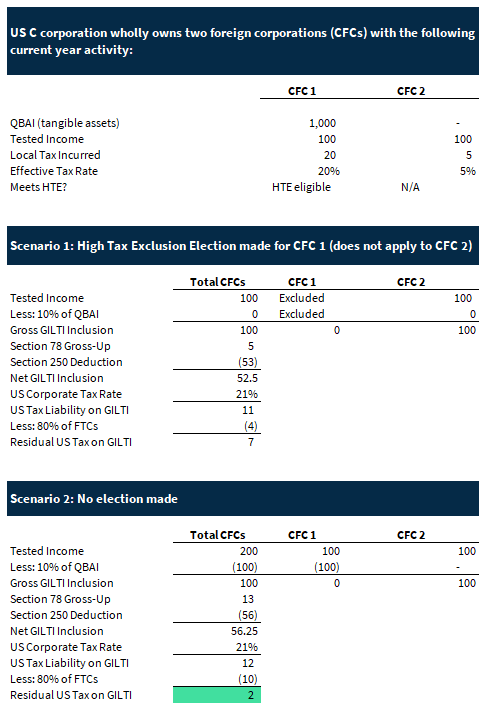

Global Intangible Low Tax Income Working Example Executive Summary Mksh

Gilti High Tax Exception Final Regulations

Gilti High Tax Exception Considerations Bennett Thrasher

Instructions For Form 5471 01 2022 Internal Revenue Service

Harvard Yale Princeton Club Ppt Download

Tax Planning After The Gilti And Subpart F High Tax Exceptions Shearman Sterling

Let S Talk About Form 5471 Information Return Of U S Persons With Respect To Certain Foreign Corporations Htj Tax

Gilti High Tax Exclusion How U S Shareholders Can Avoid The Negative Impact Sc H Group

Latest International Tax Regulations Update Final Gilti High Tax And Fdii Youtube

Guidance For Gilti High Tax Exception Forvis

Worldwide Interest Expense Apportionment A Provision Worth Keeping

Proposed Irs Tweaks To Gilti Regs Seen Giving Break To American Taxpayers Resident In High Tax

The Costs And Benefits Of The Gilti High Foreign Tax Exception Accounting Services Audit Tax And Consulting Aronson Llc